The rise of the sharing economy, led by innovative platforms like Airbnb, has disrupted traditional industries and transformed the way people travel and earn supplemental income. However, this rapid growth has also sparked concerns about the potential for tax evasion among Airbnb hosts. This comprehensive research study aims to examine the validity of these claims, providing data-driven analysis and insights into the complex relationship between Airbnb, its hosts, and tax compliance.

Across the hospitality industry, the emergence of home-sharing platforms has posed new challenges for tax authorities, as the line between personal and commercial activities has become increasingly blurred. Airbnb, one of the largest and most prominent players in the home-sharing market, has faced scrutiny over the tax implications of its business model. This research study delves into the intricacies of Airbnb’s operations, the revenue-generating mechanisms for hosts, and the tax obligations that may arise from hosting on the platform.

By examining the tax regulations and enforcement measures implemented by various jurisdictions, the study aims to separate fact from fiction, addressing common misconceptions about tax evasion and exploring the strategies employed by Airbnb and its hosts to ensure compliance. The research also investigates the role of Airbnb in facilitating tax compliance, as well as the factors that influence host behavior and decision-making when it comes to meeting their tax obligations.

Through a series of case studies and interviews with industry experts, this research study provides a comprehensive understanding of the tax implications surrounding Airbnb, addressing the broader economic and social impacts of the sharing economy. By shedding light on the complex interplay between technology, regulation, and taxation, the findings of this study will inform policymakers, industry stakeholders, and the general public on the realities of Airbnb and tax evasion.

Key Takeaways

- The research study explores the controversial topic of Airbnb and tax evasion, examining the validity of claims and providing data-driven analysis.

- The study delves into the complexities of the home-sharing economy, tax regulations, and the impact on hosts, communities, and the hospitality industry.

- The research aims to separate fact from fiction, addressing common misconceptions about tax evasion and exploring the strategies employed by Airbnb and its hosts to ensure compliance.

- The study investigates the role of Airbnb in facilitating tax compliance, as well as the factors that influence host behavior and decision-making when it comes to meeting their tax obligations.

- The findings of this study will inform policymakers, industry stakeholders, and the general public on the realities of Airbnb and tax evasion.

Overview of Airbnb's Business Model

Airbnb, the renowned peer-to-peer accommodation platform, has revolutionized the vacation rental industry. Its innovative business model allows individuals to list and rent out their homes, apartments, or rooms to travelers seeking an alternative to traditional hotel stays. This section delves into the inner workings of Airbnb, examining how the platform generates revenue and the tax implications for its hosts.

How Airbnb Works

At the core of Airbnb’s operations is a user-friendly platform that connects property owners, known as “hosts,” with potential guests seeking unique and affordable accommodations. Hosts can list their available spaces, set their own prices, and manage bookings through the Airbnb website or mobile app. Guests, on the other hand, can browse a vast selection of listings, read reviews, and book their desired accommodations with just a few clicks.

Revenue Generation for Hosts

Hosts on the Airbnb platform have the opportunity to generate supplemental income by renting out their properties. The revenue generated can vary significantly, depending on factors such as the location, size, and amenities of the property, as well as the demand for the listing. Hosts typically keep a portion of the total booking price, with Airbnb retaining a percentage as a platform fee.

Platform Fees and Charges

- Airbnb charges a service fee to both hosts and guests, typically ranging from 3% to 15% of the total booking price.

- Hosts may also be subject to additional taxes, such as occupancy taxes or registration fees, which can vary depending on local peer-to-peer accommodation taxation and vacation rental regulations.

- Guests may be responsible for paying any applicable taxes, such as sales tax or tourism taxes, on top of the booking price.

Understanding the complexities of Airbnb’s business model, including the revenue streams and tax implications, is crucial for both hosts and guests to navigate the platform effectively and ensure compliance with relevant regulations.

Understanding Tax Implications for Airbnb Hosts

As the short-term rental market continues to thrive, Airbnb hosts must navigate a complex web of tax obligations. From rental income reporting to adhering to short-term rental laws, understanding the full scope of tax implications is crucial for maintaining compliance and avoiding potential penalties.

Taxes That May Apply

Airbnb hosts may be subject to a variety of taxes, including:

- Income tax on the rental income earned from their properties

- Occupancy tax, which is often levied by local authorities on short-term rental stays

- Sales tax on the booking fees and any additional services provided to guests

Local vs. Federal Tax Obligations

The tax landscape for Airbnb hosts can be further complicated by the fact that they may have both local and federal tax obligations. While the Internal Revenue Service (IRS) provides guidelines for reporting rental income, state and municipal governments often have their own set of rules and regulations that hosts must adhere to. Navigating this patchwork of tax requirements can be a daunting task for many Airbnb hosts.

| Tax Obligation | Common Examples |

|---|---|

| Local Taxes | Occupancy tax, hotel tax, tourist tax |

| Federal Taxes | Income tax, self-employment tax, capital gains tax |

Understanding the nuances of local and federal tax requirements is crucial for Airbnb hosts to ensure they are in full compliance and avoid potential legal and financial consequences.

Common Misconceptions About Tax Evasion

When it comes to taxes and the hospitality industry, there are often misconceptions surrounding tax evasion. It’s crucial to clearly define the legal boundaries and distinguish between legitimate tax avoidance strategies and unlawful tax evasion.

Definition of Tax Evasion

Tax evasion is the deliberate and illegal act of not paying one’s fair share of taxes. This can include underreporting income, overstating deductions, or completely failing to file tax returns. In the context of the hospitality industry, tax evasion by Airbnb hosts would be a serious offense with potential legal consequences.

Misinterpretation vs. Legal Tax Minimization

However, it’s important to note that not all tax-related actions by Airbnb hosts are considered evasion. Legal tax minimization strategies, such as claiming eligible deductions or taking advantage of tax credits, are entirely permissible and often encouraged by tax authorities. These practices are common in the traditional hospitality industry as well, and should not be conflated with unlawful tax evasion.

By understanding the distinctions between tax evasion and legitimate tax minimization, Airbnb hosts can ensure they are complying with relevant hospitality industry taxes and avoiding any potential legal issues.

Case Studies: Airbnb Hosts and Tax Compliance

Navigating the landscape of Airbnb taxes and tax compliance can be a complex journey for many hosts. In this section, we delve into real-world case studies that shed light on the diverse experiences of Airbnb hosts when it comes to fulfilling their tax obligations.

Profiles of Compliant Hosts

Sarah, an Airbnb host in San Francisco, has been meticulously tracking her rental income and expenses since she started hosting. She utilizes online accounting tools and consults with a tax professional annually to ensure she is meeting all local and federal tax compliance requirements. Sarah’s commitment to tax compliance has not only provided her with peace of mind but has also enabled her to maximize her rental income while avoiding potential penalties.

Instances of Non-Compliance

In contrast, James, an Airbnb host in New York City, has experienced challenges with tax compliance. Unfamiliar with the complex tax landscape, James initially failed to report a portion of his rental income, leading to a surprise audit and subsequent fines from the IRS. This experience has been a valuable lesson for James, who now works closely with a tax specialist to ensure he is fulfilling all his tax obligations and avoiding the pitfalls of Airbnb tax evasion.

These case studies highlight the diverse experiences of Airbnb hosts when it comes to tax compliance. While some hosts, like Sarah, have embraced the importance of accurate record-keeping and timely tax filings, others, like James, have faced the consequences of non-compliance. Understanding these real-world examples can help inform and guide other Airbnb hosts in navigating the complex tax landscape successfully.

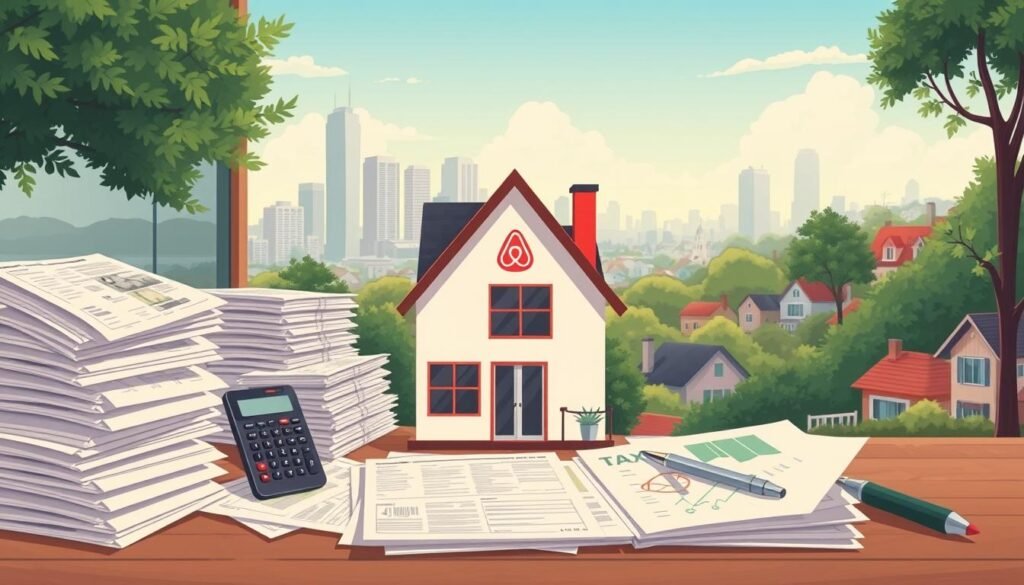

Tax Authority Regulations and Enforcement

As the popularity of short-term rentals and vacation rentals continues to grow, tax authorities have stepped up their efforts to ensure proper compliance with applicable laws and regulations. The Internal Revenue Service (IRS) has issued clear guidelines for hosts operating in the short-term rental market, while state and local governments have implemented a range of rules and enforcement measures to address the tax implications of this rapidly evolving industry.

IRS Guidelines for Short-Term Rentals

The IRS has provided specific guidance for individuals who rent out their properties on a short-term basis, such as through Airbnb or other platforms. These guidelines outline the tax obligations and reporting requirements that hosts must adhere to, including the need to declare rental income, claim applicable deductions, and maintain meticulous records.

State and Local Tax Rules

- Many states and local municipalities have enacted short-term rental laws and vacation rental regulations to address the unique tax considerations of the sharing economy.

- These regulations often mandate the collection and remittance of sales taxes, as well as the payment of occupancy or hotel taxes, by hosts and platforms.

- Enforcement efforts may include regular audits, penalties for non-compliance, and even the potential revocation of operating licenses for hosts who fail to meet their tax obligations.

| Jurisdiction | Tax Regulations for Short-Term Rentals | Enforcement Measures |

|---|---|---|

| New York City | Hosts must collect and remit 8.875% sales tax, as well as a 5.875% hotel occupancy tax. | Regular audits, fines for non-compliance, and potential license revocation. |

| San Francisco | Hosts must obtain a short-term rental certificate and collect a 14% hotel tax. | Monitoring of listings, penalties for unlicensed rentals, and collaboration with platforms to ensure compliance. |

| Chicago | Hosts must register with the city, collect a 4.5% hotel tax, and pay a $60 annual fee. | Inspections, fines, and potential legal action for hosts who fail to register or remit taxes. |

As the short-term rental industry continues to evolve, tax authorities are working to strike a balance between supporting economic growth and ensuring that all participants contribute their fair share to the local and national tax base.

The Role of Airbnb in Facilitating Tax Compliance

As the sharing economy continues to grow, the issue of taxation has become increasingly complex. Airbnb, a leading platform in the short-term rental market, has recognized the importance of helping its hosts navigate the tax landscape. The company has taken several steps to facilitate tax compliance among its host community.

Reporting Tools for Hosts

Airbnb provides a range of reporting tools and resources to assist its hosts in meeting their tax obligations. The platform offers personalized tax summaries, detailing the income earned and fees paid by each host throughout the year. This information can be easily accessed and downloaded, making it simpler for hosts to prepare their tax returns.

Collaborations with Tax Authorities

Airbnb has also collaborated with tax authorities in various jurisdictions to streamline the tax collection and remittance process. In some regions, the platform has partnered with local governments to automatically collect and remit applicable taxes on behalf of hosts, ensuring that the appropriate levies are paid. These strategic partnerships demonstrate Airbnb’s commitment to supporting the sharing economy taxation and Airbnb taxes compliance efforts.

By providing comprehensive reporting tools and enhancing its collaboration with tax authorities, Airbnb is playing a pivotal role in promoting tax compliance among its host community. This proactive approach not only benefits the hosts but also contributes to the overall transparency and sustainability of the sharing economy taxation landscape.

| Airbnb Tax Compliance Initiatives | Description |

|---|---|

| Personalized Tax Summaries | Detailed income and fee reports for hosts to prepare tax returns |

| Tax Authority Collaborations | Partnerships to streamline tax collection and remittance process |

| Automated Tax Collection | Automatic collection and remittance of applicable taxes for hosts |

Factors Influencing Tax Compliance Among Hosts

Understanding the factors that influence tax compliance among Airbnb hosts is crucial in addressing the complex issue of tax evasion in the short-term rental industry. Host motivation and their level of understanding regarding tax obligations play a significant role in determining compliance rates.

Host Motivation and Understanding

Many Airbnb hosts may not have a comprehensive grasp of their tax responsibilities, leading to unintentional non-compliance. Factors such as the perceived complexity of tax laws, lack of financial expertise, and the desire to maximize profits can all contribute to a host’s reluctance to fully comply with tax regulations. Educating hosts on the importance of tax compliance and simplifying the reporting process can help address this knowledge gap and encourage more responsible tax practices.

Impact of Local Regulations on Behavior

The patchwork of local short-term rental laws and regulations can also significantly impact host behavior when it comes to tax compliance. In areas with stricter enforcement and clear guidelines, hosts are more likely to comply with their tax obligations. Conversely, in regions with ambiguous or lenient regulations, some hosts may be tempted to underreport their income or avoid paying taxes altogether. Harmonizing tax policies and enforcement across different jurisdictions can create a more level playing field and incentivize hosts to maintain full tax compliance.

| Factor | Impact on Tax Compliance |

|---|---|

| Host Motivation | Hosts motivated by profit maximization may be more likely to underreport income or avoid taxes, while those with a strong sense of civic duty are more likely to comply. |

| Tax Knowledge and Understanding | Hosts with a better understanding of tax laws and their obligations are more likely to comply, while those with limited knowledge may inadvertently fail to meet their tax responsibilities. |

| Local Regulations | Stricter short-term rental laws and effective enforcement mechanisms encourage hosts to comply, while ambiguous or lenient regulations can create opportunities for evasion. |

By addressing these key factors, policymakers and Airbnb can work together to promote a culture of tax compliance among short-term rental hosts and ensure that the sharing economy contributes its fair share to local and federal tax revenues.

The Consequences of Tax Evasion

While the potential benefits of Airbnb hosting may seem enticing, it is crucial for hosts to understand the serious consequences that can arise from engaging in tax evasion strategies. Failure to comply with tax obligations can lead to severe legal ramifications and substantial financial penalties that can have a lasting impact on both the host’s finances and reputation.

Legal Ramifications for Hosts

Airbnb hosts who deliberately underreport their income or attempt to evade taxes can face a range of legal consequences. These may include criminal charges, such as tax fraud or tax evasion, which can result in hefty fines and even potential jail time. Additionally, hosts may be subject to audits, back-tax assessments, and penalties from tax authorities, further compounding the legal and financial burden.

Financial Penalties and Fines

- Unpaid taxes, plus interest and penalties, can quickly accumulate, often amounting to thousands or even tens of thousands of dollars.

- Fines levied by tax authorities can be substantial, sometimes reaching up to 100% of the underpaid taxes, along with potential criminal penalties.

- In severe cases, hosts may face asset seizures, wage garnishments, or other aggressive collection measures by tax agencies, further exacerbating their financial woes.

The consequences of tax evasion can be far-reaching and long-lasting, undermining the very benefits that Airbnb hosting may have provided. It is essential for hosts to understand their tax obligations and engage in tax avoidance strategies that are compliant with the law to avoid these potential pitfalls.

International Perspectives on Airbnb and Taxation

As the peer-to-peer accommodation industry continues to evolve, the taxation of vacation rentals and Airbnb-style properties has become a global issue. Across countries, there are significant variances in the tax regulations and approaches to taxing these short-term rental platforms.

Variances in Tax Regulations Across Countries

The taxation of Airbnb hosts and vacation rental properties can vary widely from one country to another. Some nations, like the United States and Canada, have established specific guidelines and reporting requirements for Airbnb hosts to ensure they meet their tax obligations. In contrast, other countries, such as certain European nations, have been slower to implement comprehensive tax regulations for the peer-to-peer accommodation sector.

Global Case Studies

- In the United Kingdom, Airbnb hosts are required to report their rental income and pay applicable taxes, including income tax and value-added tax (VAT).

- In France, the government has worked closely with Airbnb to facilitate tax compliance, with the platform providing hosts with detailed tax reporting information.

- In Japan, the introduction of the “Minpaku” law in 2018 has regulated the short-term rental market, including tax collection requirements for Airbnb-style accommodations.

- In Australia, the taxation of vacation rentals and Airbnb-style properties has been a subject of ongoing debate, with some states and territories taking different approaches to regulation and taxation.

These global case studies illustrate the diverse ways in which countries are addressing the taxation of peer-to-peer accommodation and vacation rental regulations. As the industry continues to evolve, it will be crucial for policymakers and tax authorities to collaborate with platforms like Airbnb to ensure fair and effective taxation practices are in place.

The Impact of Airbnb on Local Economies

The rise of the sharing economy, led by platforms like Airbnb, has had a significant impact on local communities across the globe. While the hospitality industry has long been a crucial contributor to the economic well-being of cities and towns, the emergence of Airbnb has introduced both benefits and potential risks to local economies.

Benefits to Community Revenue

The presence of Airbnb in a given area can generate additional revenue for local governments through taxes and fees. Hosts on the platform are often required to collect and remit occupancy taxes, which can provide a steady stream of income for municipal budgets. Additionally, the increased tourism and visitor spending associated with Airbnb can lead to a boost in sales tax revenue for the community.

Potential Risks of Evasion on Local Services

However, the issue of tax evasion among some Airbnb hosts has raised concerns about the potential negative impact on local services. When hosts fail to properly report and pay the required taxes, it can result in a shortfall of funding for essential public infrastructure, such as roads, schools, and emergency services. This, in turn, can diminish the quality of life for residents and strain the resources of local governments.

The hospitality industry taxes paid by traditional hotels and bed and breakfasts play a crucial role in supporting the local economy, and the sharing economy taxation from Airbnb hosts should be viewed in a similar light. Ensuring compliance and fair contribution from all accommodations providers is essential for maintaining the overall well-being of the community.

| Benefit | Risk |

|---|---|

| Increased tax revenue from Airbnb hosts | Potential tax evasion and underpayment by some hosts |

| Boost in tourism and visitor spending | Strain on local services and infrastructure due to lack of tax contributions |

| Diversification of the local economy | Unfair competition with traditional hospitality businesses |

As the sharing economy and hospitality industry continue to evolve, it is crucial for policymakers, Airbnb, and local communities to work together to ensure that the benefits of this new model are balanced against the potential risks, particularly in the realm of taxation.

How Tax Evasion Claims Affect Airbnb's Reputation

The topic of Airbnb taxes and tax compliance has been a subject of intense media scrutiny and public debate in recent years. As the home-sharing platform has grown in popularity, concerns have been raised about whether Airbnb hosts are adequately reporting their rental income and paying their fair share of taxes.

Media Coverage of Tax Evasion Issues

The media has played a significant role in shaping public perception of Airbnb’s tax practices. Numerous news outlets have published reports highlighting instances where Airbnb hosts have been accused of failing to declare their rental income or comply with local tax regulations. These stories have often painted a negative picture of the platform, suggesting that tax evasion is a widespread issue among its user base.

Public Perception of Airbnb and Hosts

The media coverage of Airbnb’s tax-related controversies has undoubtedly influenced the public’s view of the platform and its hosts. According to a recent survey, over 60% of respondents believe that Airbnb hosts are more likely to evade taxes than traditional hotel owners. This perception could have significant implications for Airbnb’s reputation, potentially undermining trust in the platform and deterring potential users from listing their properties or booking stays.

To address these concerns, Airbnb has taken steps to educate its hosts on their tax obligations and provide tools to facilitate tax compliance. However, the lasting impact of the tax evasion narrative on the company’s public image remains to be seen.

“The tax evasion claims have certainly cast a shadow over Airbnb’s reputation, and the company will need to work hard to regain the trust of both hosts and guests if it wants to maintain its position as a leading player in the short-term rental market.”

Strategies for Airbnb Hosts to Ensure Compliance

As an Airbnb host, maintaining compliance with tax regulations is crucial for ensuring a successful and sustainable rental income. Two key strategies that can help Airbnb hosts navigate the complexities of rental income reporting and tax compliance are keeping accurate financial records and utilizing professional tax preparation services.

Keeping Accurate Financial Records

Meticulous record-keeping is the foundation of tax compliance for Airbnb hosts. This includes meticulously documenting all rental income, expenses, and relevant deductions. By maintaining detailed financial records, hosts can ensure they are accurately reporting their rental income and claiming all eligible tax credits and deductions.

Utilizing Tax Preparation Services

Navigating the tax landscape for Airbnb hosts can be complex, with various local, state, and federal regulations to consider. Utilizing the services of a qualified tax professional can greatly simplify the process and ensure tax compliance. Tax preparers can provide guidance on applicable laws, help maximize deductions, and ensure accurate rental income reporting.

By implementing these strategies, Airbnb hosts can confidently maintain compliance with tax regulations, avoid penalties, and maximize their rental income while fulfilling their civic responsibilities.

“Staying on top of tax obligations is crucial for Airbnb hosts to maintain the integrity of their rental business and avoid potential legal and financial consequences.”

The Future of Airbnb and Tax Regulation

As the short-term rental industry continues to evolve, the regulatory landscape surrounding Airbnb and other vacation rental platforms is also undergoing a transformation. Policymakers and tax authorities are grappling with the unique challenges posed by the sharing economy, leading to a flurry of new short-term rental laws and vacation rental regulations that aim to strike a balance between innovation and compliance.

Trends in Short-Term Rental Legislation

Across the globe, local and national governments are implementing a range of measures to address the growth of short-term rentals. Some common trends include:

- Mandatory registration and licensing requirements for hosts

- Restrictions on the number of days a property can be rented out

- Zoning laws that limit where short-term rentals can operate

- Increased taxes and fees for rental hosts

- Collaborative enforcement efforts between platforms and authorities

Possible Changes in IRS Policies

As the IRS continues to scrutinize the tax implications of the sharing economy, there is a possibility of changes in IRS policies that could impact Airbnb hosts and their tax obligations. Some potential shifts include:

- More stringent reporting requirements for rental income

- Clearer guidelines on the deductibility of expenses for short-term rentals

- Increased enforcement and auditing of Airbnb hosts suspected of tax evasion

- Collaboration between the IRS and Airbnb to facilitate tax compliance

These evolving regulations and policy shifts will undoubtedly shape the future of Airbnb and other short-term rental platforms, compelling hosts to stay vigilant and ensure their compliance with all applicable short-term rental laws and vacation rental regulations.

Ethical Considerations Regarding Tax Contributions

As the sharing economy, particularly the hospitality industry, continues to evolve, the debate around fair taxation has become increasingly complex. Airbnb hosts, who play a crucial role in this dynamic sector, face unique ethical responsibilities when it comes to their tax contributions.

The Debate Around Fair Taxation

The question of what constitutes “fair” taxation in the sharing economy is a subject of ongoing discussion. Some argue that Airbnb hosts, as participants in the sharing economy, should be subject to the same tax obligations as traditional hospitality providers. Others contend that the flexible and part-time nature of hosting warrants a more nuanced approach to taxation.

Host Responsibilities in Society

Airbnb hosts, as members of their local communities, have a social responsibility to contribute their fair share of taxes. This not only ensures the equitable distribution of public resources but also upholds the principles of civic duty. Hosts who actively engage in tax compliance demonstrate a commitment to the well-being of their neighborhoods and the broader hospitality industry.

Ultimately, the ethical considerations surrounding tax contributions in the sharing economy require a balanced approach that takes into account the unique characteristics of Airbnb hosting, the need for fair taxation, and the host’s responsibilities to their community and society at large.

Conclusion: The Reality of Airbnb and Tax Evasion

This comprehensive research study has shed light on the nuanced relationship between Airbnb and tax compliance. Contrary to popular misconceptions, the findings suggest that tax evasion among Airbnb hosts is not a widespread reality, but rather a complex issue that requires a balanced understanding of the regulatory landscape and host responsibilities.

Key Takeaways from the Research Study

The study has revealed that the majority of Airbnb hosts strive to comply with their tax obligations, recognizing the importance of contributing to the communities they serve. However, instances of non-compliance do exist, often stemming from a lack of understanding or misinterpretation of the tax regulations. Airbnb has taken steps to enhance transparency and facilitate tax compliance by providing hosts with reporting tools and collaborating with tax authorities.

Future Implications for Hosts and Platforms

As the sharing economy continues to evolve, the need for clear and consistent tax regulations will become increasingly crucial. Airbnb hosts must stay informed about their tax responsibilities and maintain meticulous financial records to ensure compliance. Meanwhile, platforms like Airbnb will likely face growing pressure to enhance their role in promoting tax compliance, potentially through enhanced reporting features and stronger partnerships with tax agencies. The ethical considerations surrounding fair taxation will remain a key focus, with both hosts and platforms needing to demonstrate a commitment to their civic responsibilities.

FAQ

What is the definition of tax evasion?

Tax evasion is the illegal practice of not paying taxes, often through misrepresenting income or claiming unauthorized deductions. It is distinct from legal tax minimization strategies.

How do Airbnb hosts generate revenue?

Airbnb hosts earn revenue by renting out their properties or rooms to guests through the Airbnb platform. The platform charges fees to both hosts and guests for facilitating these transactions.

What types of taxes may Airbnb hosts be required to pay?

Airbnb hosts may be subject to various taxes, including income tax, occupancy tax, and sales tax. The specific tax obligations depend on the host’s location and local regulations.

How does Airbnb assist hosts with tax compliance?

Airbnb provides hosts with reporting tools and resources to help them comply with tax regulations. The platform also collaborates with tax authorities to streamline the tax collection and remittance process.

What are the potential consequences of tax evasion for Airbnb hosts?

The consequences of tax evasion for Airbnb hosts can include legal ramifications, such as fines and penalties, as well as potential reputational damage and impact on their ability to continue hosting on the platform.

How do local regulations and laws affect tax compliance for Airbnb hosts?

The tax compliance of Airbnb hosts is heavily influenced by local regulations and laws governing short-term rentals and vacation rentals. Hosts must be aware of and adhere to these rules to avoid potential issues.

How does tax evasion affect the reputation of Airbnb and its hosts?

Media coverage and public perception of tax evasion issues related to Airbnb can have a significant impact on the platform’s reputation and the reputation of its hosts. This can lead to increased scrutiny and potential regulatory actions.

What strategies can Airbnb hosts use to ensure tax compliance?

Airbnb hosts can ensure tax compliance by keeping accurate financial records, utilizing professional tax preparation services, and staying up-to-date with the latest tax regulations and reporting requirements.

How might tax regulations and policies change in the future for the sharing economy?

As the sharing economy continues to evolve, there are likely to be changes in short-term rental legislation and IRS policies to address the unique challenges posed by platforms like Airbnb. Hosts should stay informed of these developments.

What are the ethical considerations surrounding tax contributions in the sharing economy?

The debate around fair taxation in the sharing economy raises ethical questions about host responsibilities, the impact on local communities, and the role of platforms in promoting tax compliance and contributing to the broader hospitality industry.